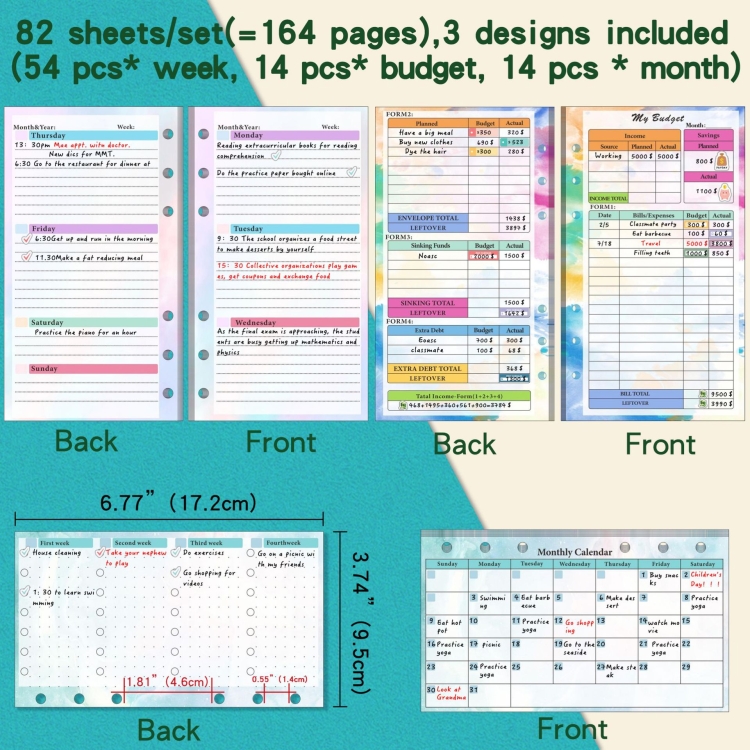

A6 6 Hole Budget Book Loose-leaf Replacement Core Handbook Insert, Spec: Monthly Plan 56 Sheets Introduction

Budgeting is a very important aspect of one's financial security, and an effective system can greatly influence the management of personal and corporate finances. The A6 6 Hole Budget Book Loose-leaf Replacement Core Handbook Insert borne in the Monthly Plan form with 56 sheets fits the bill for someone interested in tracking finances efficiently. This budget-book insert stands as a tool to maintain financial discipline, track expenses, and plan for the future.

Such an expense tracking tool offers a simple yet incredibly effective way of documenting income and expenses. Unlike digital apps and spreadsheets whose use may prove challenging to the uninitiated, users can have this insert in the more hands-on approach towards preparing for their economic future. Writing down financial transactions improves the consciousness of spending behavior among users. With consciousness comes good habits; now, the users would be more involved in consciously spending their money in the right direction each month.

Design and Practicality

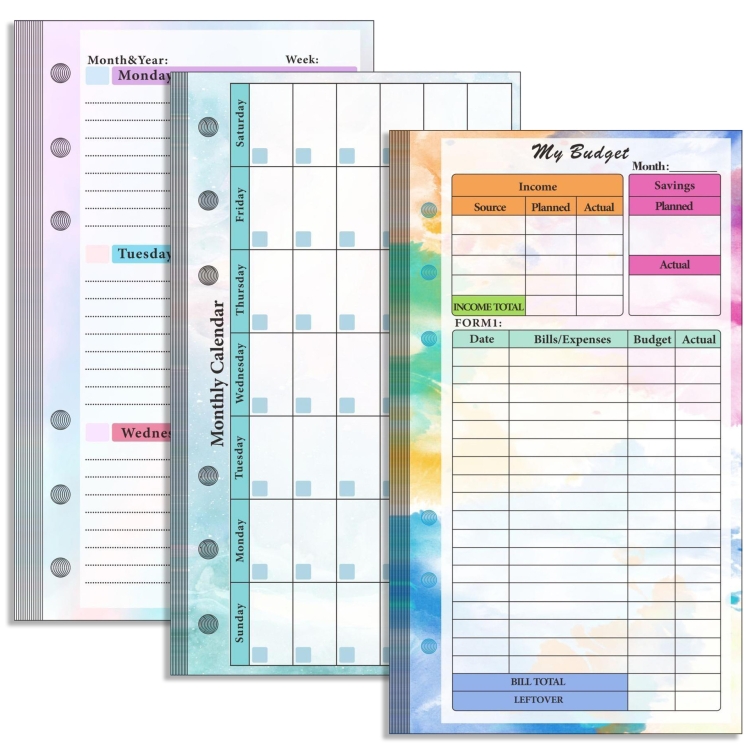

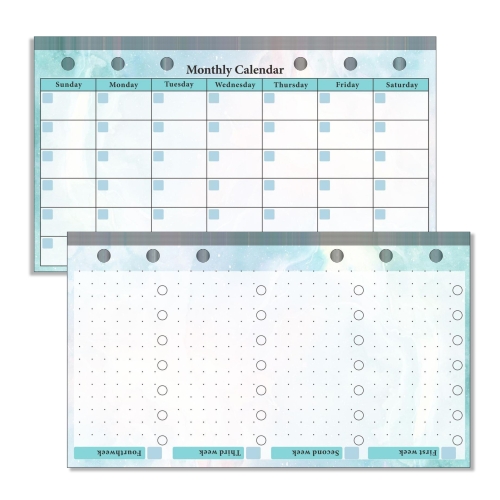

The size helps the budget book insert fit into almost any pocket or pouch while leaving sufficient room for financial entries. The six-hole punching means it can fit into practically any A6 ring binder, enabling the user to slip it into existing planning systems. With about 56 sheets of monthly planning, this insert has plenty of pages for a whole year's worth of financial record tracking. This high-quality paper ensures a smooth writing experience with minimum bleed-through and thus is suited for a variety of writing implements.

The layout facilitates easy reading, enabling the user to locate relevant information in no time. Income, expenditures, and savings sections ensure that one keeps an orderly approach to budgeting; therefore, users can easily look at financial data from month to month and determine trends, pinpoint areas where they have overspent, and correct such behaviors. Sturdiness could be one more bonus; these pages can undergo much wear and tear without falling apart. Given that financial records need to be updated regularly, this quality means that no matter what, you can expect a good condition for your budget book throughout the year.

Efficiency In Financial Planning

The advantages of a well-planned budget system are countless, while this unique budget book insert improves financial management by giving the user an overview of income versus expenses. By simply filling in the plan for the month, one can manage every financial activity and avoid overspending. It serves as a reminder for being more careful, bills being able to be adjusted with the amount left for other purposes, and regular financial habits. Regularly recording financial transactions goes a long way toward better financial management.

Having different sections for all categories of expenses, be it groceries, utilities or entertainment or savings will help identify spending patterns and adjust when needed. Any updates made to the budget book will keep accurate financial records. Be it the tracking of daily expenses or a review of weekly transactions, consistency is key. The established method also assists in planning future expenditures, such as vacations, large purchases, or emergency funds.

With a budget book, one of the greatest advantages is being able to see the entire financial picture at one glance. A bank app would list transactions, while a budget book inserts income and expenses side by side. This snapshot of financial status allows users to decide if they are living within means or need to curb expediture on certain things.

Customization And Flexibility

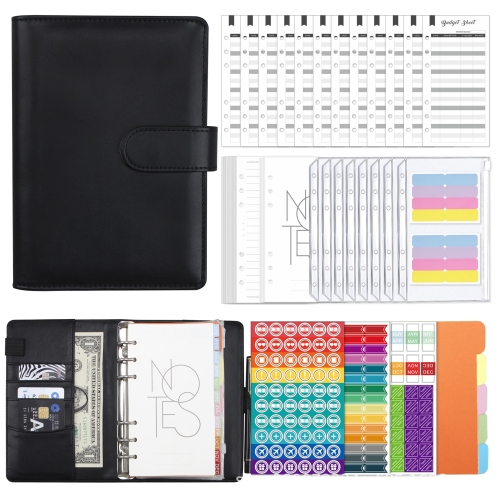

The loose-leaf design supplies flexibility in that users are able to rearrange or remove pages. Unlike bound notebooks, this insert easily allows customization of financial records by adding'sheets or removing older information. Its compact size and portability enable users to carry it anywhere for access to personal financial information.

Color-coded pens or highlighters could differentiate between income and expenses for ease in reading financials. It would also ease navigation by way of tabs or sticky notes from one month to another. The next monthly financial review allows for consideration of financial progress, areas needing change, and goal setting for the next month. Customization options are a fun way to engage a consumer and spur them into maintaining their budgeting habits.

Traditional Versus Digital

For the manual budgeters targeted by the insert, it is an effective and tangible way to handle their finances. Writing down expenses manually makes a person more aware of finances and creates a better connection with spending habits. Also, the print format ensures privacy and security, so there are no worries about a data breach or unauthorized access.

Since apps may require internet access or updates, the A6 6 Hole Budget Book Insert is always available with no dependence on technology. Physical entries into the budget and expenses make the need for more conscious spending more clear for many users. The simplicity of a manual budget system also promotes reduced distraction since there are no notifications or advertisements to interfere with the planning of finances.

Another significant benefit of a physical budget book is privacy, as digital budgeting apps store their data online, thus posing possible safety risks. The budget book is available, with an assurance that all your financial information is kept secure without having to worry about unauthorized access. This particular budget book insert is significant for offline-oriented individuals in financial planning without going through any learning curve.

Fit for all users

This budget book insert suits all categories of users from students to professionals and business owners. Students may demand the use of it in monitoring their allowances, spending, and developing positive financial attitudes. Professionals will be able to benefit from structured budgets for monitoring their salaries, expenses, and savings. It's a household budget-tracking form for grocery, bills, and all other household expenses.

Entrepreneurs and small business owners can add this budget book insert to their financial systems to manage income, expenses, and profits. It's also a good companion for someone practicing the cash envelope budgeting scheme, which details cash flow. Individuals will certainly find this budget book insert invaluable-having financial goals such as the repayment of debts, emergency savings, or investment planning. The simplicity and clarity that characterize this method of budgeting offer the perfect solution for just about anyone, regardless of financial background.

Organization and review for finances

Using a standardized approach for recording transactions ensures that financial records are well organized. Color coding can be used to differentiate the different types of expenses-thus useful in understanding what is being classified under what category. Receipt keeping or writing a note about significant transactions can provide additional context for the tracking activity.

Trend analyzing for spending provides a good base for making decisions about adjusting the plan. A backup of all essential financial records also prevents their loss in case of any unfortunate incidence. And for the individual who wants minimalist records, an overview of all financial insights could be summarized at the end of each month for a quick check without the clutter of pages. For extra motivational quotes or goal trackers, budgeting can also be made quite fun and rewarding experience.

Conclusion

Monthly scheme of 56 sheets makes A6 6 Hole Budget Book Loose-leaf Replacement Core Handbook Insert an effective personal and professional finance management tool. Small in size, it boasts an organized informational design coupled with flexible features for any user interested in continuing a life of financial discipline. Sharing this budget book insert in together with spouse financial activities will make budgeting discipline, responsible spending, and financial independence above average.

Be it a case of household budgeting purposes, business administration, or saving goals, this individual budget book insert is quite efficient and reliable for checking things off. The shift has taken place, and as spending becomes really budgeted, this is a good and worthy investment in attaining that much-sought financial independence; this budget book inserts itself as yet another efficient way towards realizing that goal. Maximum utility, durability, and flexible application; this is the kind of insert that every serious financial planner needs to have. The budgeting process becomes a monotonous aspect of everyday life, at which time the user will take control of his financial future with complete confidence.